Governor Moore unveils $63.1B budget for FY2025 with the hopes of closing state deficit

MARYLAND – Maryland Governor Wes Moore announced his Fiscal Year 2025 budget Thursday. It comes with a price tag of $61.3 billion, and an aim on funding key areas in the state while growing revenue, and reducing the deficit, all without raising taxes.

The budget includes a record $127 million for police across the state. That makes for an increase of $5 million, when compared to Fiscal Year 2024.

“You cannot have safer communities without supporting law enforcement to get it done. Boots on the ground do not just help us to prevent crime and help us to react to crime, but to solve cases,” Gov. Moore said.

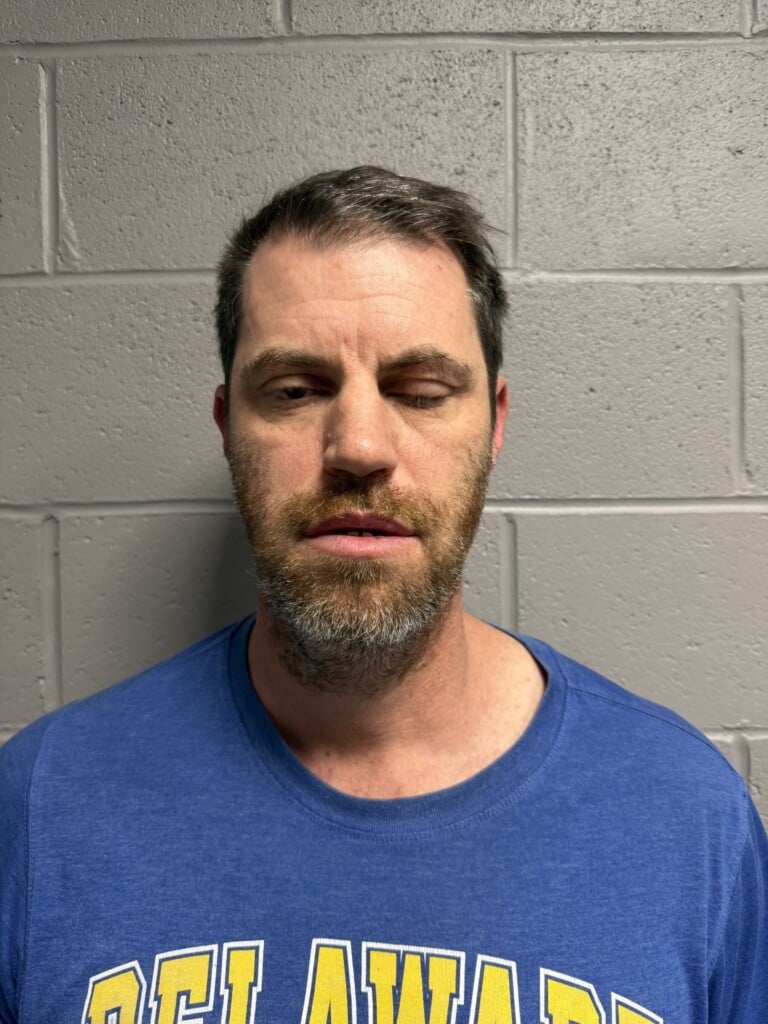

Worcester County Sheriff Matt Crisafulli tells 47 ABC WMDT that for his department, he hopes that any increase in funding would go additional resources.

In a statement to 47 ABC WMDT, Sheriff Crisafulli said that that would go their body-worn camera program. “Due to unfunded state mandates, such as BWC programs, causes law enforcement agencies to have to hire support staff to run these critical functions, these functions are cumbersome and take additional staffing to accurately implement the necessary components,” he wrote.

Salisbury Area Chamber of Commerce President Bill Chambers believes that an increased focus on public safety across the state will make it an easier sell for businesses looking to move in.

“It’s going to be significant to assist us here,” Chambers said. “The City of Salisbury, the Lower Eastern Shore, you know, we’re having our police departments poached by neighboring states offering higher salaries.”

Chambers also hopes to see a measure addressing retail theft and juvenile crime also make its way through the legislative session this year.

The governor’s budget also took aim at rising costs in childcare. Gov. Moore pointed to the issue as the driver of a 5% dip in workforce participation from women across Maryland. He called the costs, combined with housing, a major factor in the strain that Maryland families are feeling.

“This budget includes the largest single-year investment in child care in our state’s history,” Gov. Moore said, pointing to $270 million to support the Child Care Scholarship program announced in the new budget.

However, the budget also showed some of the ways the government is paying for big-scale programs without new taxes. It includes a “one-time cash injection” for the state’s transportation fund, which is being taken from the state’s rainy day fund to the tune of $150 million.

“This is the wrong time to be hitting the rainy day fund, in the face of a deficit,” said Maryland State Senator Johnny Mautz.

Sen. Mautz says he is concerned that the spending is not sustainable, and could see more local burden to help fund projects once the state dollars run out; something he says already happened with the Maryland Blueprint for Education reform coming out of the Kirwan Commission.

“The costs, I mean, it’s not good. It’s not doable for many of our local jurisdictions, and this budget doesn’t fix that,” Sen. Mautz said.

The state senator also pointed to a state versus local split on items like a $60,000 starting salary for teachers and universal Pre-K.

Chambers says he believes Wicomico County, in particular, will need to start planning on how to pay for those expenses. “If you’re in a county like ours with a revenue cap, the rubber’s going to meet the road when the bill comes up from the state for the local portion of Kirwan,” he said.

Gov. Moore says the budget would increase the ease and effectiveness of businesses coming to Maryland. He also said he needs the state to be competitive, to get out of the 2% annual growth slump that he believes is the cause of the state’s deficit.

“I continue to hear from entrepreneurs and business leaders who still say it is still too busy, is still too difficult to grow your business in the state of Maryland,” Gov. Moore said.

Chambers says one solution could be to follow the lead of Pennsylvania and Virginia, and slash the corporate rate in the state to attract new businesses.

“If we add businesses and add jobs in Maryland, that adds to the tax base absolutely would work. There’s a reason why our neighbors to the north are lowering theirs to under 5%. They see an opportunity to attract businesses, and that’s what Maryland needs,” Chambers said.