Tax deadline approaching, tips for successfully filing

DELMARVA – With the tax deadline fast approaching, preparers say you need to file soon if you don’t want to deal with late fees. The deadline for no fees when filing your tax returns is April 18th.

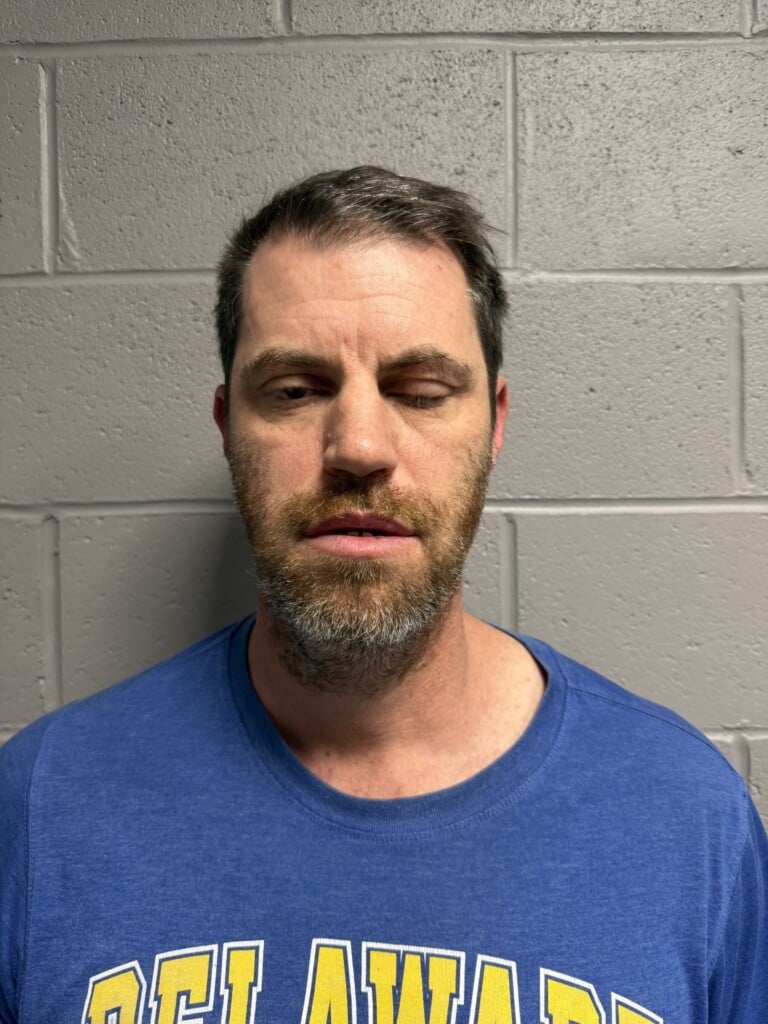

April is the busy season for Corey Boerner, owner and personal accountant of Balanced Financial Services in Salisbury. He stresses that a well filed tax return is crucial for building good credit.

“Companies who are looking for credit are going to look at proof of income and a tax return is the ultimate proof of income because it tells the IRS how much you made this year,” Boerner said.

He said that clients for his business pick up in February, slow down in March, and April marks his busy season.

“I’ve got varieties who will come in in February with everything ready and some people who come in with just a box and say here is my mess, figure it out, “Boerner said. “I take all types and in between.”

Not filing or filing late can lead to the IRS sending you a Failure to File fee.

It can cost anywhere from 4-5 hundred dollars, not counting any additional monthly interest or late fees added on top.

“It can be a pretty hefty fine, especially if you are a business, and they charge the businesses more than that,” Boerner said.

Maryland Comptroller Brooke Lierman says timing is everything when Filing your tax return.

“The earlier people file their taxes, the quicker they get their tax refund,”Lierman said. Certainly, those tax refund are import for consumers and for all Marylanders. That’s why we encourage people to file their taxes early so that we can get them their refund as early as possible.

Both Lierman and Boerner say, lower income Marylanders should especially pay attention to the Earned Income Tax Credit. If you have children at home, take the child care expenses into account with the EITC.

“If you need help, if anybody needs help setting up a payment plan, you can get in touch with us and making sure filing that tax return on time is essential to get that process started,” Lierman said.