Financial tips from expert to budget your money during inflation

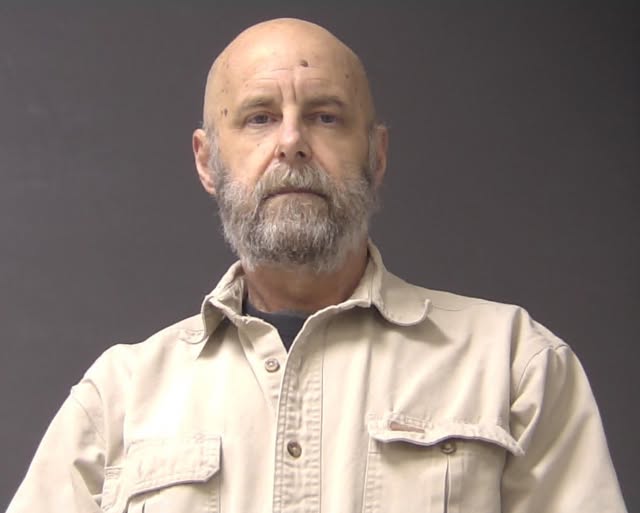

DELMARVA – 47 ABC sat down and spoke to a certified financial planner who shares his expertise in planning for the future, in light of the current economic status.

Brent Fuchs with Heritage Financial Consultants tells us, that with record high inflation there’s no time like the present to start evaluating your finances, establish a goal, and develop a plan. The plan should include setting up bill pay or automatic payments, or budgeting for your needs such as bills, gas, and food while opting out of frivolous spending for the month. “Track your spending, there’s a reason when they play a baseball game they keep score, you’re either winning or you’re losing. So when you’re tracking your budget, keep the score at the end of the month,” says Fuchs. He adds, “Before you sit down and pay the mortgage and pay the electric bill, I want you to pay yourself first. Whether that’s building your emergency fund for higher inflation or if you’re laid off, or things like that, pay yourself first.”

Fuchs also tells 47 ABC, that many people are focused on trying to pay current bills while also taking the advice of building a 6-month emergency fund. Although that may seem like a good plan, he says it’s not always realistic for everyone. He says to slowly build that up, you have to gradually clean up your debt. “A lot of people want to go to the highest interest rate credit card. What I like to do is take the smallest balance you have and get that cleaned up first. Take the minimum payment or whatever payment you were doing and go to the next one.” Fuchs adds, “Don’t procrastinate, do something small, it’s called the latte effect. Even if we go from a large to a small, you’re saving a couple of dollars especially if you’re shopping at Starbucks.”

Fuchs also says every month you should be re-evaluating your budget and adjusting accordingly. “In today’s environment right now with inflation running as hot as it is, we’re going to go over budget now and again.” Fuchs adds, “If you take a look at it every month, you can make small adjustments to maybe make up for that gas tank that cost 50% more.”

With these tips, Fuchs says you have a chance to make find a way to have more financial literacy, while also preparing yourself for the future.