Trump’s tax proposal’s Delmarva effect

The new, controversial Republican tax plan was released by Donald Trump earlier this week. But if it passes – what will it mean for those here on Delmarva?

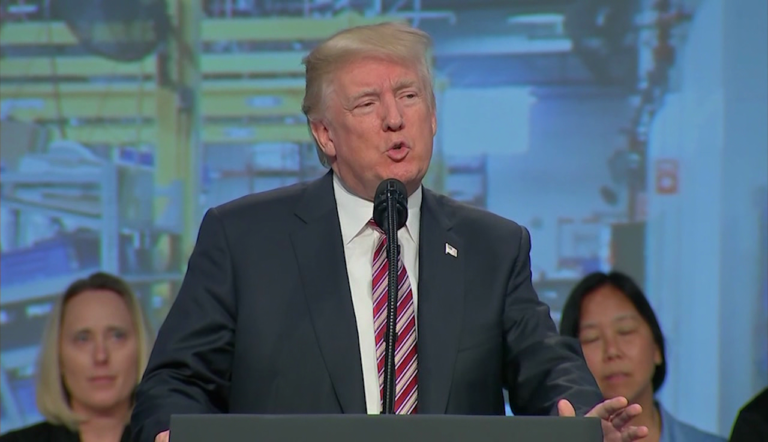

"My administration is working every day to lift the burdens on our companies and on our workers so that you can thrive, compete, and grow," Trump said in a recent speaking event.

Trump has called it the biggest tax cut in the country's history. But for those that are still a little hazy on what exactly it will do, experts are also still unsure.

"Without knowing the specifics of the plan, we're so early in the process," said Dr. Brian Hill, Salisbury University economics and finance department chair. "It's tough to say local impacts."

Here's what we do know; the number of tax brackets is set to be reduced from seven to three, but according to Hill, how that will be applied is still vague.

"We need to know what income ranges those rates will apply to have any sort of idea about the distributional effects," he said.

The outline also proposes the corporate tax rate dropping to 20% and doubling the standard deduction for our income tax. But, for those small business owners and farmers on Delmarva, there's a big piece that may help business grow.

"The pass-through tax rates are gonig to be cut from 25% at the cap. So, if they were making, earning income that was being taxed at a higher rate prior to this bill, they're going to benefit from that," added Hill.

And also part of the proposal? Plans to help the 1%.

"[It will be] eliminating the estate tax, eliminating the alternative minimum tax. A lot of these things are targeted towards high income households," said Hill.

Democrats have been skeptical of the plan. Maryland Senator Chris Van Hollen tells 47ABC it would be bad news for the Eastern Shore. He says this is more trickle down economics, that will increase the national debt by three to four trillion dollars over the next decade.